Mining Truth: About those jobs, jobs, jobs (Part 5)

Local Chambers of Commerce in northeastern Minnesota are some of the loudest voices in support of PolyMet and Twin Metals’s proposed copper-nickel sulfide mines. It’s commonly believed that opening a new mine would help businesses, bring new workers and expand the population. In fact, these beliefs are so widely held that they are hardly ever examined. But these claims deserve scrutiny, and there is a way to judge their truth.

This series has delved deeply into the economic questions surrounding proposed copper-nickel sulfide mines in northeastern Minnesota, examining questions like:

- Will mining companies live up to their job promises? In Part One, we learned that company job estimates keep getting trimmed, and promised “value-added” jobs have been jettisoned.

- Will these jobs be good union jobs? In Part Two, I showed that the copper mining industry is virulently anti-union, and that they’ll do their utmost to prevent workers from organizing any new mine.

- Will opening a new mine decrease unemployment in northeastern Minnesota? In Part Three, I introduced data from Safford, Arizona that shows that a new mine opening increased both employment and unemployment due to increased volatility.

- Will spinoff and indirect jobs increase local incomes? In Part Four, we looked at data from Safford that showed that wages have been flat for decades and that the share of local income from wages continued to fall despite the 2006 opening of the Safford mine.

With that, let’s try to answer another important question: does opening a new mine improve business income and increase local population? In the Safford Micropolitan Statistical Area, comprised of Graham and Greenlee Counties in southeastern Arizona, the answer is no. The opening of the Safford mine in Arizona in 2006 demonstrates that adding a new mine to an existing mining district did not create significant population growth, nor did business income improve.

Population Growth

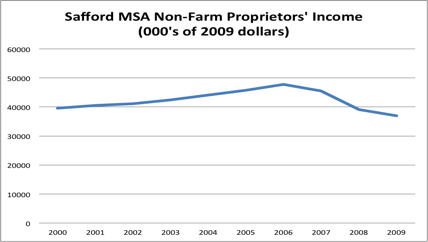

Proprietors’ income is business earnings from sole proprietorships and partnerships. According to the Morrison Institute for Public Policy’s “Arizona Indicators,” “average proprietors’ income is the counterpart to the average wage as a measure of individual economic well-being.” Since farm income shouldn’t be affected by the opening of a nearby mine, it has been excluded from the following analysis.

Total Safford area non-farm proprietors’ income is lower in 2009 than it was in 2000, and declined in 2007 and 2008 despite the opening of the Safford mine.

Source: U.S. Department of Commerce Bureau of Economic Analysis. Regional Data: Other Local Areas Personal Income and Employment: Personal Income and Employment Summary (CA04): Safford Micropolitan Area (2000-2009). http://www.bea.gov/iTable/index_regional.cfm. 2009 Dollars calculated with U.S. Department of Labor Bureau of Labor Statistics. “CPI Inflation Calculator.” http://146.142.4.24/cgi-bin/cpicalc.pl.

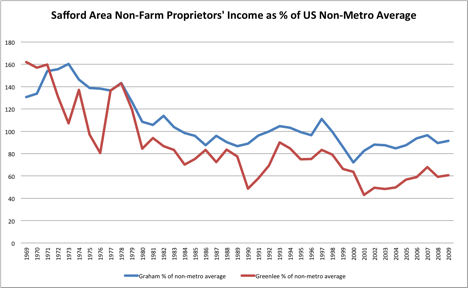

This chart depicts the inflation adjusted total business income in the Safford area, but another way to express the health and strength of the business economy is to examine average income by dividing the total by the number of proprietors. Benchmarking that average income to the national average for non-metro counties shows that Graham and Greenlee counties remain significantly under the national non-metro average, even after the opening of the Safford mine.

Source: Arizona State University Morrison Institute for Public Policy. ”Arizona Indicators.” Economy: Prosperity and Productivity: Average Nonfarm Proprietors’ Income. http://arizonaindicators.org/content/average-nonfarm-proprietors-income.

Graham and Greenlee counties have experienced a long-term decline in proprietors’ income and are both under the national average for non-metro counties. The Morrison Institute for Public Policy indicates that “[r]easonable targets for Arizona are for […] the nonmetro counties to have a figure within 5 percent of the [U.S.] nonmetro average.” In 2009, Graham County proprietors’ income was 91.6% of the national average, and Greenlee County was at 60.6% of the average. Greenlee County has the lowest average proprietors’ income in Arizona.

The long-term trend in the Safford area is also important to keep in mind. Like the Iron Range, the Safford area was once a prosperous mining area, with above average business income. Then labor strife, low metal prices, and mine closures in the late 1970’s and early 1980’s radically reshaped the economy, and led to a long-term decline in business income. Despite a momentary uptick, the opening of the Safford mine hasn’t changed that overall trend.

This is an important lesson for those who would pin their economic development hopes on new mines in northeastern Minnesota. The lack of diversification in the Safford area bodes poorly for sustainable economic and population growth. The sugar high of a new mine development quickly faded into a headache of lower business income, higher unemployment, and continued population stagnation.

This is the likely outcome from opening a new copper-nickel sulfide mine or two in northeastern Minnesota, even assuming there is no significant economic downside from lost tourism jobs. And somehow, nobody ever thinks about those jobs. But that’s where I’ll go next. In Part Six, I’ll look at the role that tourism plays in the local economy, the economic impact of BWCA visitors, and the potential for attracting new entrepreneurs who want to live near wilderness.

Thanks for your feedback. If we like what you have to say, it may appear in a future post of reader reactions.